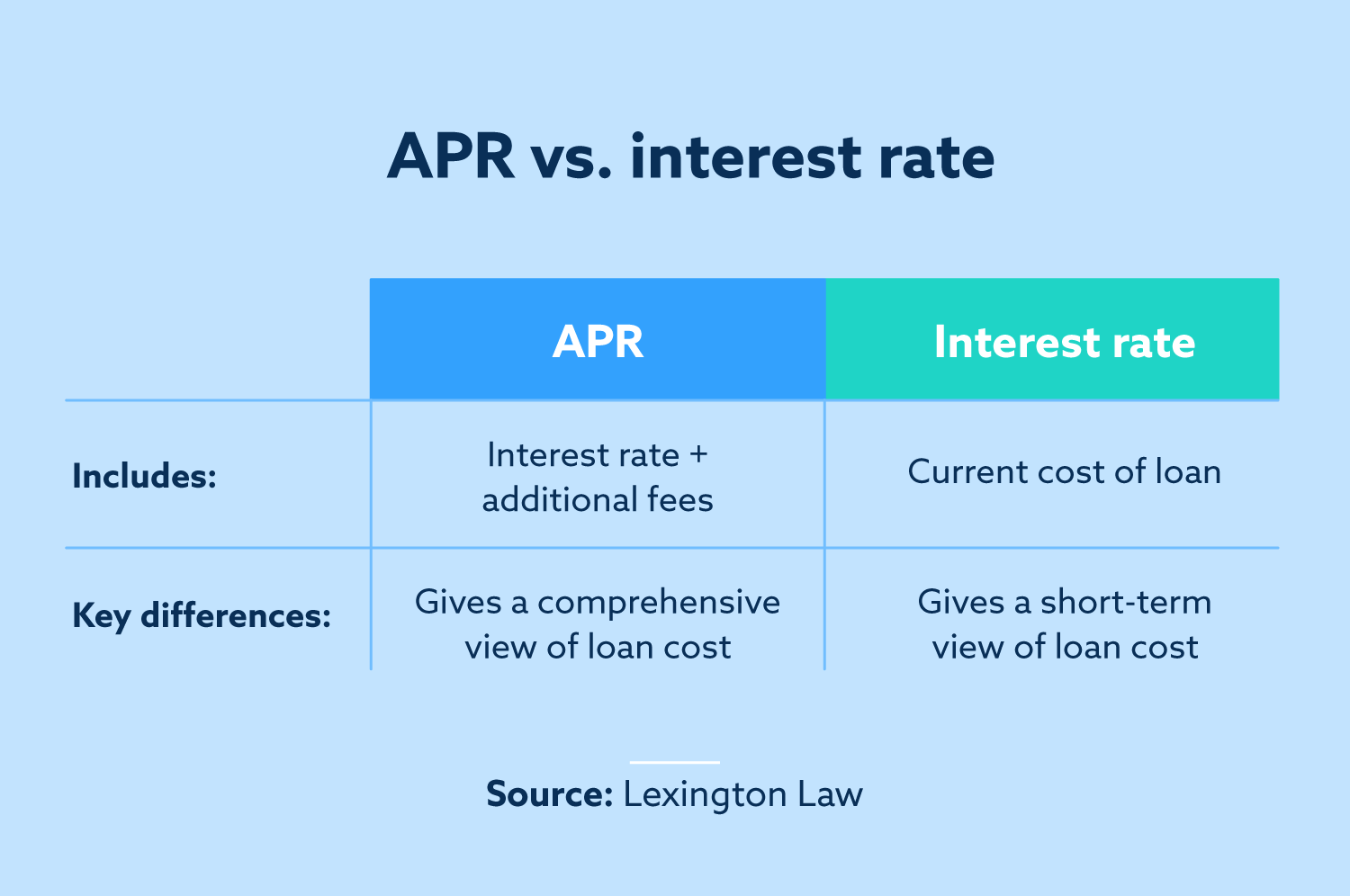

When you apply for a loan, you are often presented with two important numbers: the Interest Rate and the Annual Percentage Rate (APR). While they sound similar, understanding their difference is crucial to knowing the true cost of your loan.

What is an Interest Rate?

The interest rate is simply the cost of borrowing the principal loan amount, expressed as a percentage. For example, if you take a loan of ₹1,00,000 at a 12% annual interest rate, this percentage represents the base cost of borrowing.

What is APR?

The Annual Percentage Rate (APR) is a broader measure of the cost of borrowing. It includes not only the interest rate but also any additional fees and charges associated with the loan, such as:

- Processing fees

- Service charges

- Other mandatory charges

Because it includes these extra costs, the APR gives you a more complete picture of what you'll actually pay over a year. It's the "all-in" cost of your loan.

Why is APR More Important?

A lender might offer a very low-interest rate to attract you, but then charge high processing fees. By comparing the APR from different lenders, you are comparing the loans on a like-for-like basis. A loan with a slightly higher interest rate but lower fees might have a lower APR, making it the cheaper option.

At Teofin, we and our lending partners believe in transparency. We always encourage you to check the APR in the loan agreement to understand the full cost of your loan.

Apply Now with Transparent Terms